Why your altcoin isn’t pumping and when it finally will

Bitcoin has hit new all-time highs, yet most altcoins keep bleeding. Why? This article examines the factors behind this dynamic and what needs to happen before we see a proper alt season.

Bitcoin has hit new all-time highs, yet most altcoins keep bleeding against it. You might wonder: Why isn't your altcoin pumping? Multiple factors have fundamentally changed how this crypto cycle works. This article covers these factors and what needs to happen before we can see the kind of alt season we all dream of.

Monetary Policy favors Bitcoin

The most fundamental factor driving altcoin underperformance is the continuation of quantitative tightening. History shows that Bitcoin tends to outperform during periods of tight monetary policy, while alt seasons typically emerge only after a shift to quantitative easing begins.

The persistence of quantitative tightening has made this cycle significantly longer than previous ones. Last cycle, it took about 87 weeks from the peak for alt/Bitcoin pairs to reach range lows. We're now at around 178 weeks - more than twice as long - precisely because quantitative tightening has continued far longer than in previous cycles. This sustained period of Bitcoin outperformance while altcoins bleed against it explains why this bull market feels so different from what traders experienced in previous cycles.

The reason tightening persists is that the consumer economy has proven resilient. Despite high interest rates, we haven't seen the economic weakness that would typically force the Federal Reserve to pivot. Recent Fed statements suggest quantitative easing isn't coming anytime soon - Powell has explicitly stated that QE is a tool they only use when rates are already at zero. Getting to that point would require significant economic pain first, likely causing altcoin prices to suffer considerably before any potential recovery.

However, while QE might trigger a great altseason, the emerging economic environment could offer an alternative path forward, which we'll explore in detail later. The market might not need to wait for a Fed pivot - and endure the associated economic pain - to see altcoins thrive again.

Lack of new market participants

Social metrics reveal that many retail traders haven't returned yet. While Bitcoin hits new highs, engagement metrics across crypto platforms remain far below previous bull market levels. Looking at views on crypto YouTube channels illustrates this clearly - during the 2021 peak, these channels collectively averaged around 4 million views per day. This cycle, we've only seen brief spikes reaching 2 million views.

In previous cycles, new participants invested in technology-focused coins that appreciated over time. As they profited, they stayed and brought friends into the ecosystem, creating sustainable growth. Now, whenever social engagement rises, memecoin speculation takes off. New participants quickly lose money in rug pulls, causing them to leave the ecosystem entirely instead of reinvesting and bringing others in.

The Trump token launches perfectly exemplify this dynamic. What could have been a catalyst for retail engagement turned into a negative experience as most non-crypto-native participants lost money. Without positive experiences to restore confidence, normies remain hesitant to return.

This lack of retail participation shows in market behavior. Instead of new money flowing in, we're seeing the same traders rotating capital between opportunities. This explains why we've only had pockets of outperformance in specific altcoins rather than a sustained alt season.

The missing retail component impacts price action. In previous alt seasons, like 2017 and 2021, social engagement metrics showed sustained upward trends with higher lows. Currently, every time social engagement rises above certain thresholds, it quickly retreats. Without durable retail participation, the market lacks the buying pressure needed to sustain broader altcoin rallies.

Pump.fun impacts altcoin price action

The launch of pump.fun fundamentally changed how speculative capital moves through the altcoin market. Value extraction from the market has accelerated to unprecedented levels. When retail capital enters these meme launches, it quickly flows to platform fees and insider groups who quickly cash out. This rapid extraction of capital from the crypto ecosystem makes sustained rallies nearly impossible, as new money constantly leaves the system instead of sticking around and enabling sustained altcoin rallies. We can observe that up to the pump.fun launch (the yellow line) altcoin performance tracked what we’ve seen in previous cycle, ever since they underperform.

The platform has also transformed how quickly markets move. While it previously took weeks or months for copycats and new shiny coins to emerge, now hundreds appear within days. This efficiency in launching new tokens spreads the available demand so thin that no project can maintain momentum.

This shift has also changed how traders approach investments. Previously, people bought into assets they believed in, giving projects room to grow through sustained holding. Now, the dominance of short-term meme speculation has created a "jeet" culture where quick flips replace conviction.

Current Market Structure Issues

All these factors have led to concerning structural weaknesses in the market. While total crypto market capitalization is rising, the top altcoins aggregated are actually declining. This means only a select few coins - mainly Bitcoin - are lifting the entire market cap, while everything else bleeds value. Even Ethereum hasn't reached a new all-time high yet - something that happened much earlier in previous cycles.

Looking at the advanced decline index for the top 100 altocins reveals the extent of this issue. When total market cap rises while this index falls, it signals a divergence: Bitcoin and a handful of altcoins are responsible for the market cap growth, while most cryptocurrencies actually contribute negatively.

The sheer number of tokens competing for attention creates additional pressure on the top coins. Compared to previous cycles, we now have significantly more coins, many with aggressive vesting schedules. This means available capital gets spread thinner across projects, while constant token unlocks create persistent sell pressure. Each project receives less attention and capital than in previous cycles, making sustained rallies increasingly difficult to achieve.

The current market structure is reminiscent of a "zombie bull market." Assets only rise when Bitcoin pulls them up, often going up reluctantly and without violent rallies. The minute Bitcoin shows any weakness, these altcoins collapse dramatically. This dynamic creates an environment where sustainable alt rallies become nearly impossible without consistent Bitcoin strength.

What Needs to Align for Alt Season

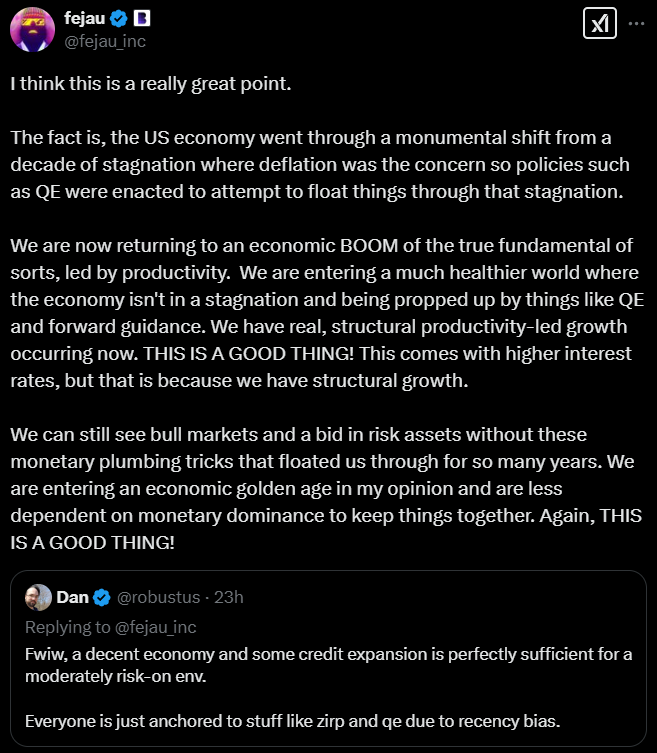

For a true alt season to emerge, multiple conditions need to align. Historically, the Federal Reserve pivoting from quantitative tightening to easing was seen as a crucial trigger. The past decade's economic environment required these monetary tools because the economy was stagnant, with deflation being the primary concern. In that context, the excess money from quantitative easing naturally flowed into speculative assets like altcoins, fueling previous bull markets.

But we're entering a fundamentally different economic era. Instead of needing artificial support through monetary policy, we're seeing real economic growth driven by productivity improvements. Companies are becoming more efficient through technological advancement, reshoring of manufacturing, and innovation in areas like AI. This creates natural, sustainable growth that can support risk assets even without monetary stimulus. Higher interest rates in this environment aren't a problem - they're actually a sign of economic health.

This suggests two possible paths to alt season. Either a traditional Fed pivot could trigger speculative flows like in previous cycles, or genuine value creation in the crypto space could drive sustainable growth even without monetary easing. The second path might actually be healthier, as it would be based on real utility rather than excess liquidity.

Regardless of which path emerges, retail traders need to durably return to the market. Social metrics need to show sustained upward trends and higher engagement, not just brief spikes of interest. This typically happens after prolonged rallies that rebuild confidence in crypto. These rallies need to be sustainable enough to give people who enter the market a positive experience to create widespread excitement.

The market also needs to shift back towards value-driven investing. While pump.fun and meme trading won't disappear, we need investors to start buying assets they genuinely believe in again. Only conviction in actual technology and innovation creates the kind of holding patterns that allow for sustained rallies. This could be triggered by genuine innovation - we saw glimpses of this potential in the AI space - or through real adoption and utility that drives sustained demand.

These conditions might seem daunting, but they've aligned before and can align again. The next alt season might look different from those of the past - the sheer number of tokens, constant unlock schedules, and the persistence of meme trading have changed market dynamics. We might not see every altcoin exploding simultaneously like in previous cycles, but we can expect a sustained period where fundamentally strong altcoins outperform and Bitcoin dominance declines. The altcoin market as a whole should thrive and reward investors who position themselves in fundamentally strong projects handsomely.