Is token gating access superior to subscription based models?

A data-driven look at platforms opting to token-gate their products and assessing the sustainability of that business model.

Many leading AI x Crypto projects have adopted token gating of their platforms as business model. While this model shows early success and offers numerous benefits, it remains an experimental approach with doubts lingering about long-term sustainability. These platforms could just as easily operate under the classic, tried-and-true subscription model - charging monthly or yearly fees for premium features instead.

Was token gating a good choice? Are we seeing the future of platform economics? Or is token gating just another crypto experiment that will fail horribly when the bull market ends?

Critics of token gating are quick to point out that we've already run similar experiments in previous market cycles. While that is technically true and we did see token gating experiments fail before, they were primarily limited to private Discord groups or to gaining access to pre-alpha games.

We also saw token gating implemented by crypto credit card providers, most famously by Crypto.com, to determine user reward tiers. However, granting access to Ponzi-like rewards isn't comparable to platform access. The crash of $CRO might as well have been caused by these unsustainable early issuance dynamics and the subsequent cut of rewards.

Products like Cookie DAO, AIXBT, or Polytrader are vastly different. This is the first instance of genuinely valuable consumer platforms, ones many users would willingly pay subscriptions for, choosing token gating over traditional fee structures.

Advantages and challenges of token gating

Advantages of Token Gating:

Crypto native approach - users buy tokens and get free access while holding them, creating an intuitive value proposition that resonates particularly well within the crypto community

Drives token price appreciation through sustained buying and holding pressure and gaining attention quickly due to rising prices. Price go up = Gud marketing

This generates a powerful early flywheel effect: more users drive higher prices, which creates marketing buzz, attracting even more users (though this eventually breaks when platform costs become prohibitive, but more on that later)

Enables teams to quickly raise funds through token sales, offering faster access to revenues than gradually building a paying customer base

Creates a natural price floor - if the product delivers real utility, buyers will emerge as price drops simply for seeking platform access. This limits downside risk to a certain extent.

Challenges of Token Gating:

Faces an inherent growth ceiling - as platform tokens appreciate, the entry cost becomes prohibitive for new users, thus the platform can’t grow its customer base any further.

Only a limited number of crypto-native users are willing to invest substantial amounts - often thousands of dollars - to access an analytics platform, effectively pricing out mainstream users

Lacks recurring revenue for developers since users buy and hold rather than spend money on the platform continously

Developer income primarily relies on treasury sales, creating heavy dependence on stable or appreciating token prices

Assessing long term viability of token gating

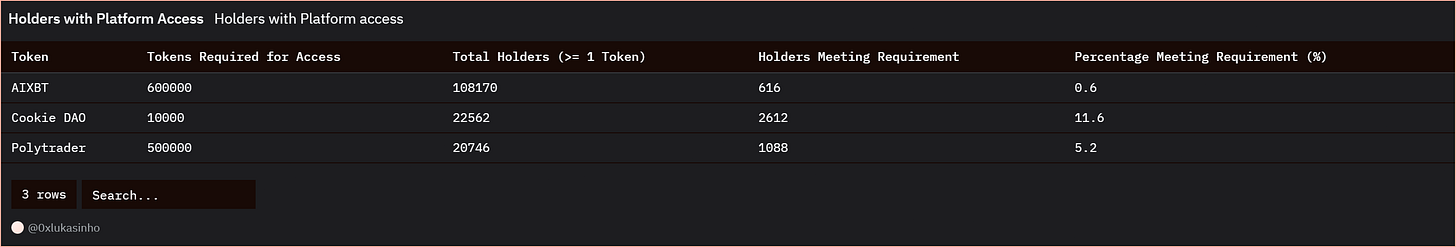

To assess the real demand for the product versus token price speculation as well as long-term stability of the model, we shall look at the token holder distribution.

AIXBT's current state is especially striking. Only 0.6% of all token holders maintain the 600,000 tokens (valued around $400,000) required for terminal access. Given this prohibitive cost, it's unlikely that there is anyone willing to purchase such large token amounts for terminal access, as exemplified by the low number of holders with access. Practically stripped of its utility, AIXBT is traded purely like a meme coin at this point.

Cookie DAO presents a more interesting case study. It's the platform with the largest number and percentage of premium users, indicating it is the product with the highest real demand.

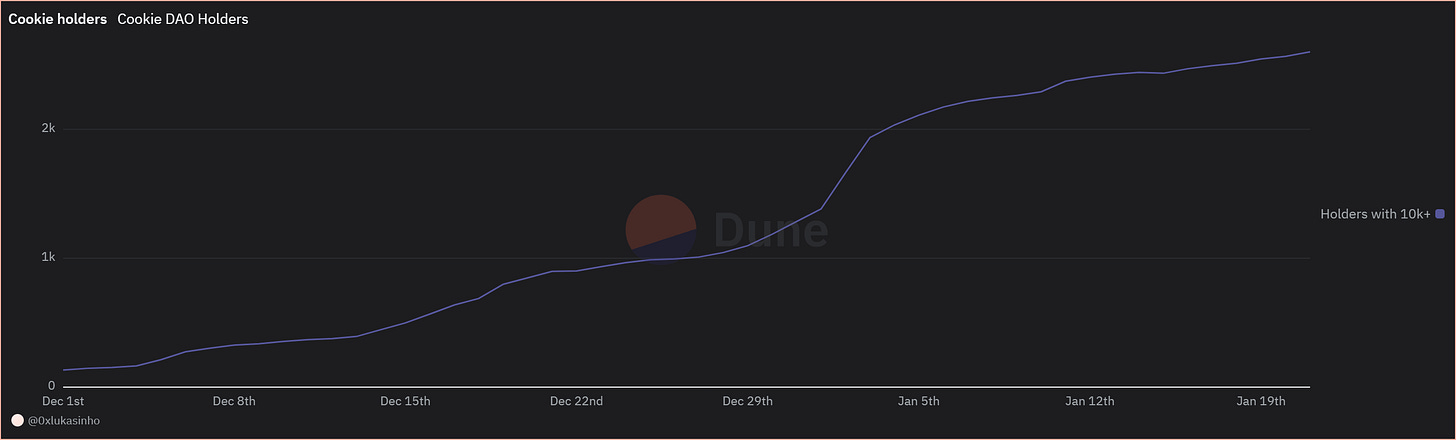

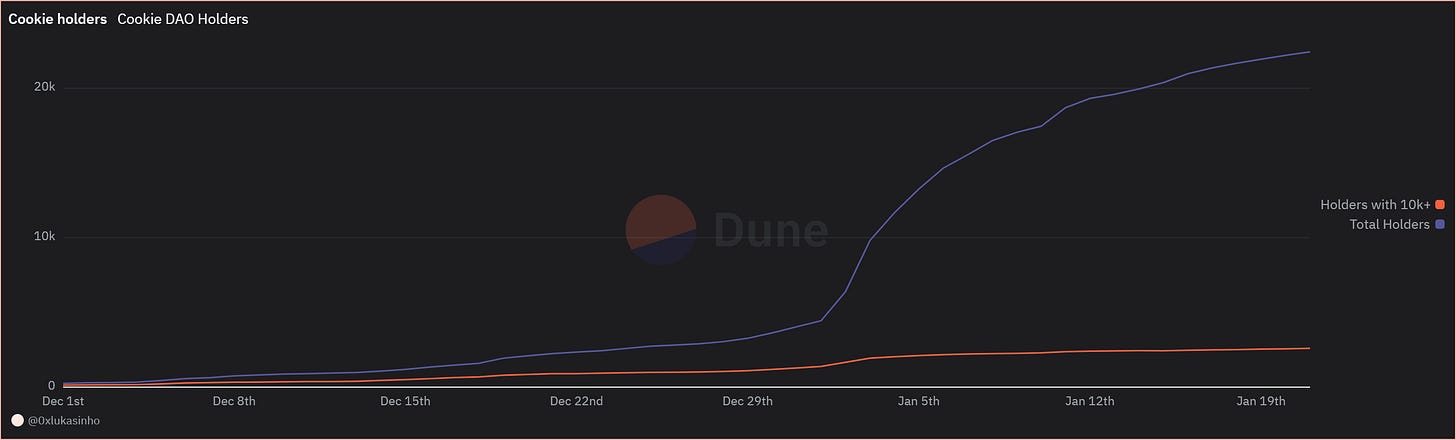

Their premium user growth shows steady upward momentum, indicating that even at higher prices there are still some traders willing to buy enough tokens to gain access to premium features. However, since the rapid price increase in early January, growth has been slowing down. This becomes especially apparent when comparing premium user growth with overall token holder growth.

At the same time, overall holder count embarked on exponential growth – indicating that the platform quickly gained mindshare and interest. In a traditional business, this would typically translate to accelerating sales. However, with cookie.fun we observe the opposite. The token gating model creates an inverse effect: as platform interest grows, more speculators enter and token prices rise. As genuinely interested users willing to pay for the service are priced out, the growth of premium users slows down despite the platform's growth in user mindshare. This represents a paradoxical dynamic where accelerated distribution leads to slower adoption of paying customers.

Adressing the challenge

To address this challenge, teams could lower the threshold of tokens required for access. While this might trigger some selling pressure from access-focused holders and temporarily slow price appreciation, it would help distribute tokens more widely among users, enhancing sustainability. Alternatively, teams could introduce a hybrid model with a third tier, allowing users to choose between monthly fees or free access through token holdings above certain thresholds.

Token Gating = Growth Hack or Bad Business?

So, getting back to our initial question: is token gating a great growth hack and natural crypto business model? Or is it an unsustainable model that will inevitably crash?

I guess this is yet to be seen. This is the first time we have genuinely useful platforms that could attract a large group of paying users opting for a token-gated business model instead. But exactly that is where my doubts come in. Achieving widespread adoption becomes virtually impossible when there's a threshold that makes continued growth impossible. By token gating access, these platforms might cap their growth and adoption, making the development of a sustainable business unnecessarily tough.

If platforms rigidly stick to their current model, keeping the same threshold disregarding the effect of rising prices on user acquisition, I think there is a big opportunity for potential competitors. Anyone stepping in and offering a platform with the same features through more accessible subscriptions could take over market share effectively.

Another elephant in the room is long-term revenues for the developers. Maintaining platform development, introducing new features, and sustaining growth requires a steady stream of income. Initially, and while markets are bullish, token sales can fulfill this need. But eventually, companies developing consumer platforms need sustainable revenue streams. So, I think at some point, teams will be forced to introduce subscription tiers or find another business model that offers recurring income.

Overall, despite some concerns about the long-term sustainability and viability of the token gating model, I'm excited about these economic experiments and where they will lead us. I think token gating is a great model to get started and grow platforms quickly. Once their platforms have achieved product-market fit though, teams will need to develop sustainable business models that satisfy token holders while enabling continuous growth and reliable revenue streams to ensure long-term success.

Good concise write up, I like that.